Table of Content

You have an adjustable-rate mortgage and the rate rises at the adjustment period. The Washington State Housing Finance Commission, or WSHFC, offers several loan programs to help qualified first-time home buyers get a mortgage. The cost of borrowing money that’s typically expressed as an annual percentage of the loan. Cherry Creek Mortgage has originated more than $78 billion in loans since launching in 1987. Today, the lender has several dozen branches and an online division, Blue Spot Home Loans, that can issue same-day preapprovals, with the average closing time between 22 and 27 days.

They anticipate purchase volume to go from $1.53 trillion in 2020 to $1.6 trillion in 2021 and $1.64 trillion in 2022. The other property tax is a state-level property sales tax. It is 1.28% and is assessed against the value of any property, residential or commercial, when it is sold. Standard rental and homeowner insurance policies typically do not cover earthquake damage, though they usually cover losses caused by fires which resulted from an earthquake.

Most and least expensive places to live in Washington, D.C.

Under-priced flood insurance in high-risk areas act as a subsidy to wealthy homeowners. Another fast growing area of Washington is the Tri-Cities area in Southeastern Washington that includes the cities of Kennewick, Pasco, and Richland. The Tri-City area economy is primarily agricultural and focused around the growth of apples, wheat, corn, and wine grapes.

For example, a 30-year mortgage might be better for someone who prefers the lowest monthly payments and plans to live in the house for a long period of time. However, if you want to pay off the home quickly, you can opt for a 10-, 15- or 20-year mortgage. The monthly payments will be higher, but the house will be paid off faster. Typically, when you belong to a homeowners association, the dues are billed directly, and it's not added to the monthly mortgage payment. Because HOA dues can be easy to forget, they're included in NerdWallet's mortgage calculator.

Embrace Home Loans

This will typically be done by phone so you should look for the Advertisers phone number when you click-through to their website. Washington State is a place of great natural beauty, and until the coronavirus clipped its wings, the economy in this state was booming. As a result, home sale prices had soared in recent years, making it hard for many homebuyers to snag a good deal. However, the recessionary climate, combined with low trending interest rates, may make the dream of affording a house in the Evergreen State a reality.

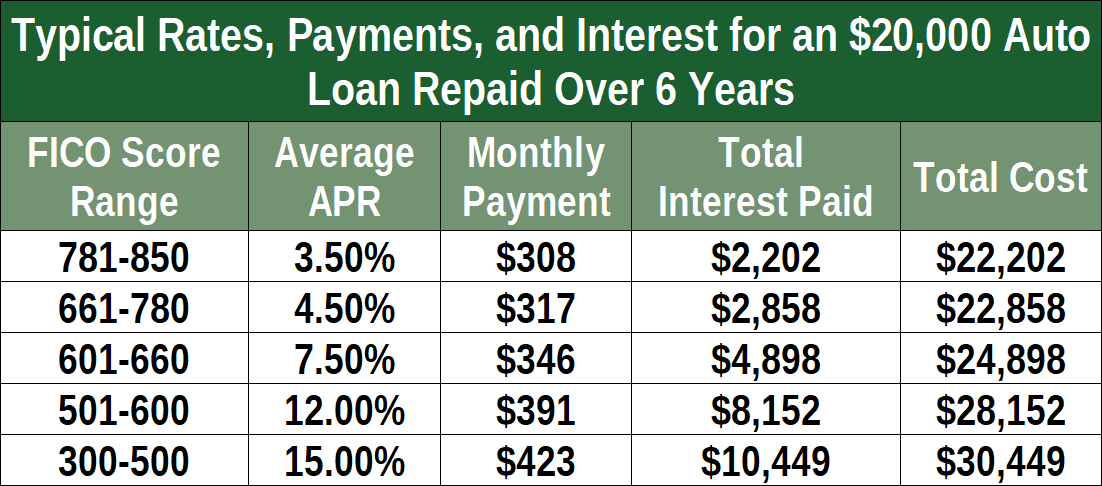

The consumer can receive a loan for as little as 3 percent down and also receive as much as 6 percent on closing costs. This means that the consumer can borrow up to 97 percent of the cost of the home. ARM Loans - Adjustable-rate loans and rates are subject to change during the loan term. That change can increase or decrease your monthly payment. APR calculation assumes a $725,000 loan with a 25% down payment and borrower-paid finance charges of 0.862% of the loan amount, plus origination fees, if applicable.

VA Loans

Your final rate will depend on various factors including loan product, loan size, credit profile, property value, geographic location, occupancy and other factors. Washington's constant influx of new residents means you’ll likely face stiff competition for good housing deals. However, knowledge of the local mortgage rates and the home buying process can increase your odds of getting a dream home in Washington.

Many investors over-extended themselves by purchasing multiple properties when prices were high. If the market turns, the home buyers may owe more than the house is worth. Those who wish to sell cannot fully recoup the costs of the home. Therefore, instead of having equity in the home, consumers owe more than the home is worth. Many individuals, in this instance will negotiate with the bank and “short sell” in order to relieve themselves of the debt. These loans are typically available in 15 year and 30 year loan options.

FHA mortgages

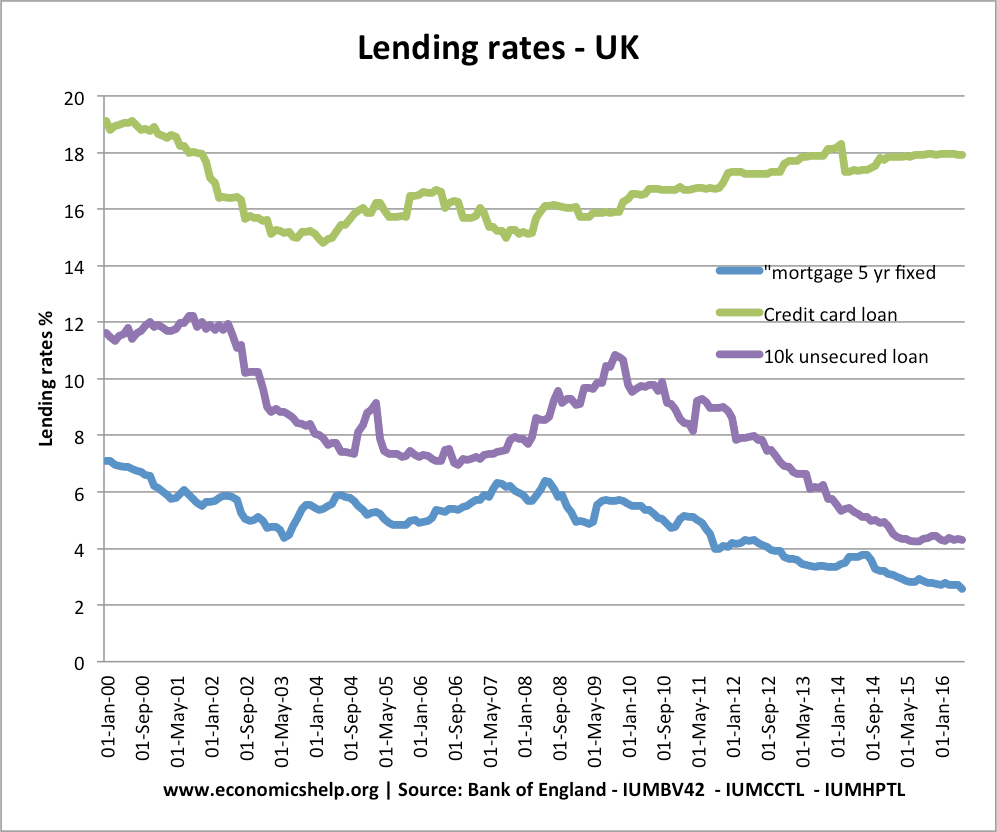

Steadily declined over 12 months starting at the end of 2018. They began rising sharply again in early 2020 before the effects of COVID-19 took hold. The best time to secure a mortgage or refinance is when the rates are the lowest. Compare the National Mortgage Rate average over the past 10 to 20 years. If the rate is at one of its lowest points historically, then it can be a safe entry point into the market.

These factors notwithstanding, the home loan process in this state is relatively simple. Washington also offers streamlined refinances, which let homeowners lower their interest rate without incurring thousands of dollars in closing costs. However, you can choose shorter 15-year or 20-year loan terms which have lower rates but higher monthly payments. As the name implies, a fixed-rate mortgage features static interest rates. These rates do not change according to market conditions, which means your monthly payment amounts will stay the same.

Cake Mortgage has funded over $3.5 billion in loans since its founding in 2018. The Chatsworth, California-based lender offers a 10-minute online application and often closes in as little as 28 days. If you have used Bankrate.com and have not received the advertised loan terms or otherwise been dissatisfied with your experience with any Advertiser, we want to hear from you. Pleaseclick hereto provide your comments to Bankrate Quality Control.

Conforming rates are for loan amounts not exceeding $647,200 ($970,000 in AK and HI). Estimated monthly payment and APR calculation are based on a down payment of 0% and borrower-paid finance charges of 0.862% of the base loan amount, plus origination fees if applicable. Estimated monthly payment and APR assumes that the VA funding fee of $6,072 is financed into the loan amount.

Estimated monthly payment does not include amounts for taxes and insurance premiums and the actual payment obligation will be greater. In addition to your principal and interest payments, a monthly mortgage payment may also include several fees, like private mortgage insurance , taxes and homeowners association fees. Jumbo Loans - Annual Percentage Rate calculation assumes a $940,000 loan with a 20% down payment and borrower-paid finance charges of 0.862% of the loan amount, plus origination fees if applicable. Jumbo rates are for loan amounts exceeding $647,200 ($970,800 in Alaska and Hawaii). However, if ARM rates exceed fixed rates in a couple years, it could mean you face higher mortgage payments when the 5/1 mortgage reaches the adjustable-rate period. So it’s important to be prepared for changes in mortgage costs when applying for a 5/1 ARM or other ARMs.

No comments:

Post a Comment