Table of Content

Under-priced flood insurance in high-risk areas act as a subsidy to wealthy homeowners. Another fast growing area of Washington is the Tri-Cities area in Southeastern Washington that includes the cities of Kennewick, Pasco, and Richland. The Tri-City area economy is primarily agricultural and focused around the growth of apples, wheat, corn, and wine grapes.

This program can be combined with up to $10,000 worth of DPA, in the form of a 30-year deferred second mortgage with a 1% rate. There are three main loan options when it comes to buying a home in America. Each has its own pros and cons, so it’s important to understand them in detail before you choose which one fits your needs.

Average property tax in Washington counties

Was named 4th most expensive U.S. city earlier this year. If your down payment on a conforming loan is below 20% of the home's value you will likely be required to carry private mortgage insurance until the loan's balance is below 80% of the home's value. Expert economists predicted the economy would rebound in 2010. However, the economy was sluggish with slow growth rates for many years beyond that. The economy contracted in the first quarter of 2014, but in the second half of 2014 economic growth picked up.

Loans which exceed these limits are classified as jumbo loans. Here is a table of cities & Census Designated Places across the United States with a population above 100,000. States with higher levels of population growth typically see the increased real estate demand drive faster real estate price appreciation.

Methodology: How we got our average number

That’s why it’s so important to shop at the outset for a realtor and lender who are experienced housing experts in your market of interest and who you trust to give sound advice. There are many ways to search for the best mortgage lenders, including through your own bank, a mortgage broker or shopping online. To help you with your search, here are some of the top mortgage lenders based on our list of this month’s best mortgage lenders. The average APR for the benchmark 30-year fixed-rate mortgage rose to 6.68% today from 6.63% yesterday. At the same time, the 15-year fixed mortgage APR sits at 5.83%, higher than it was at this time yesterday.

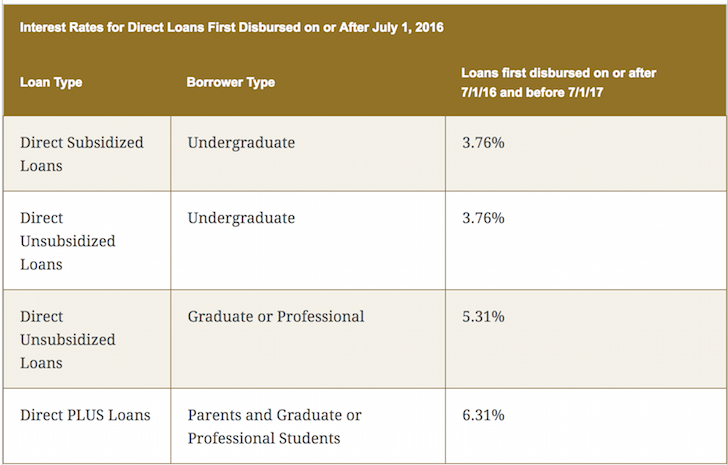

You have an adjustable-rate mortgage and the rate rises at the adjustment period. The Washington State Housing Finance Commission, or WSHFC, offers several loan programs to help qualified first-time home buyers get a mortgage. The cost of borrowing money that’s typically expressed as an annual percentage of the loan. Cherry Creek Mortgage has originated more than $78 billion in loans since launching in 1987. Today, the lender has several dozen branches and an online division, Blue Spot Home Loans, that can issue same-day preapprovals, with the average closing time between 22 and 27 days.

Washington Mortgage and Refinance Rates

Washington law forbids deficiency judgments on loans secured by deeds of trust. Homeowners who file for Chapter 7 bankruptcy can sometimes keep property valued up to 125 thousand dollars by claiming it as a homestead. Vancouver is also a strong growing metro area because of its proximity to Portland, Oregon. The Vancouver area is home to many export farms growing strawberries, cherries, and apples, although the biggest employer is local and state government. The city is undergoing a downtown revitalization project to make it more attractive to businesses and consumers.

These rates can be an entire point lower than 30 year fixed rates. Therefore, there may be significant savings in terms of interest paid to the lender. Some common hybrid ARMs are 1 year fixed, 1 year adjustable rates (1/1); 5 years fixed, 1 year adjustable (5/1); and 7 years fixed, 1 year adjustable (7/1). The adjustable rates will be based upon the federal rate when the fixed term elapses. These loans are also appealing to investors or home buyers who plan to sell in a short period of time.

Kalorama ($1.49 million median home value) — This neighborhood is known as the home of the powerful and the elite, and the prices reflect that. Berkley ($1.86 million median home value) — Tucked away in northwest D.C., the cost of healthcare, utilities and transportation in Berkley are actually cheaper than D.C. The average rate predicted for 2019 was 5.13% while the actual average rate throughout the year was 3.94%. Check your refinance options with a trusted local lender.

The consumer can receive a loan for as little as 3 percent down and also receive as much as 6 percent on closing costs. This means that the consumer can borrow up to 97 percent of the cost of the home. ARM Loans - Adjustable-rate loans and rates are subject to change during the loan term. That change can increase or decrease your monthly payment. APR calculation assumes a $725,000 loan with a 25% down payment and borrower-paid finance charges of 0.862% of the loan amount, plus origination fees, if applicable.

The median monthly cost of homeownership in the US is $1,609 per month, according to the most recent data from the Census Bureau's 2019 American Community Survey. That cost includes not only the monthly mortgage payment, but also other necessary costs like homeowners insurance, HOA fees, and property taxes. Estimated monthly payment and APR calculation are based on a down payment of 25% and borrower-paid finance charges of 0.862% of the base loan amount.

However, the market has already started to rebound, and the crisis has yet to have a major impact on the sales price of a single-family home in Seattle. With interest rates falling, prospective investors should keep a close eye on developments in the Evergreen State as the recession wears on. Prepare the money to pay your origination fees before scheduling a closing date. On the day itself, run all the closing paperwork through your realtor before signing to ensure you understand all the details. Consider making a bid above the listed property value to sweeten the deal. Consult with your realtor first on how much you should offer so you don’t overpay.

Fixed rates are based upon the national average, but vary from state to state. They possess the same interest rate throughout the duration of the loan. Consumers desire these loans if they plan to remain in their homes for the duration of the loan. For example, the consumer obtains a mortgage when interest rates are at their lowest and then interest rates rise. The consumer does not have to worry about their rates increasing because the interest rate is “fixed”.

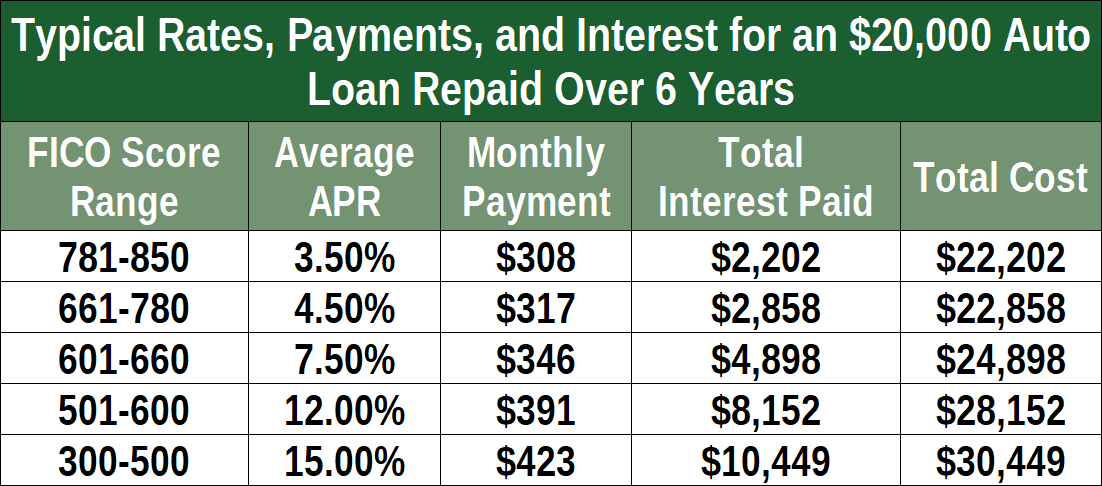

If you’re looking at homes in Washington, you’ll want to be certain you get an optimal mortgage before you purchase your home. Your rates will vary depending on several factors, such as your credit score, the amount of income you bring in, your debt-to-income ratio , and how much down payment you plan on making. Annual Percentage Rate represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender.

No comments:

Post a Comment